While Bloomberg looped the same tired chyron — “Biotech Bloodbath Deepens” for the 47th straight month, eight precision-diagnostics stocks just posted their strongest synchronized weekly gains ever.

And this time the move wasn’t driven by retail gamblers or headline-chasing algos.It was driven by the only people whose opinion actually matters: the multi-billion-dollar healthcare funds that have spent the last four years hiding in cash, waiting for the moment the risk/reward finally flipped.

This week they stopped waiting.

They hit the buy button so hard that volume-to-float ratios stayed microscopic while prices exploded 11 % to 50 % in five trading days.

That’s the signature of a rotation that is just getting started — and one the crowd won’t notice until it’s far too late.

Last Sunday I Told You the Rotation Had Already Started

I said the selloff wasn’t a catastrophe — it was the beginning of a rotation out of the exhausted giants and into the forgotten corners institutions accumulate when nobody is looking.

This week that rotation didn’t just continue.

It went nuclear.

Here’s exactly where the smart money went…

Precision Diagnostics Just Seized the Crown from AI

Guardant Health, Natera, Exact Sciences, GeneDx, GRAIL, Veracyte, RadNet, and BillionToOne…

Eight leaders that can find cancer in a single drop of blood all ripped 11 % to 50 % in five days.

Perceptive Advisors, Redmile, and ARK Genomic Revolution all added hundreds of millions to these names in the latest filings.

This is not retail noise.

This is every major healthcare fund hitting the bid at the exact same time.

When the Tools Layer Explodes with the Therapeutics Layer, a Decade-Long Cycle Has Officially Begun

TransMedics. Lumentum. Bruker. Glaukos. 10x Genomics. 60–70 % gross margins. Accelerating free cash flow. Institutional ownership north of 100 %.

When the picks-and-shovels names surge alongside the end-application names, the entire complex is screaming one thing: the drought is over.

The American Consumer Just Flipped Wall Street the Bird

While CNBC ran “Death of the Consumer” segments on loop, Brinker, Vita Coco, Crocs, BellRing, and BBB Foods staged a defiant breakout.

Negative net debt. ROEs above 20 %. Cash-flow machines.

The consumer isn’t dying.

He’s just done overpaying for the same seven stocks.

One Name We Flagged Last Sunday Just Handed Readers Another 16.6 %

Remember Terns Pharmaceuticals (TERN) — the smaller obesity-treatment challenger we told you was moving hard in our last market rotation report?

It didn’t slow down. It ripped another 16.6 % last week.'

That’s what catching real rotation early actually looks like.

The Rest of the World Just Became the Cheapest, Highest-ROE Hedge on Earth

AEON. Bangkok Bank. BPI. Fukuoka Financial.

30 % ROE compounders trading at 6 times earnings while the S&P sits at 28 times.

Global funds just started building their largest overweight in a decade.

You won’t hear about it on TV for another six to twelve months.

This Was Not Noise — This Was the Coronation

The old kings are wounded.

The new kings just took the throne.

And they did it while almost nobody was watching.

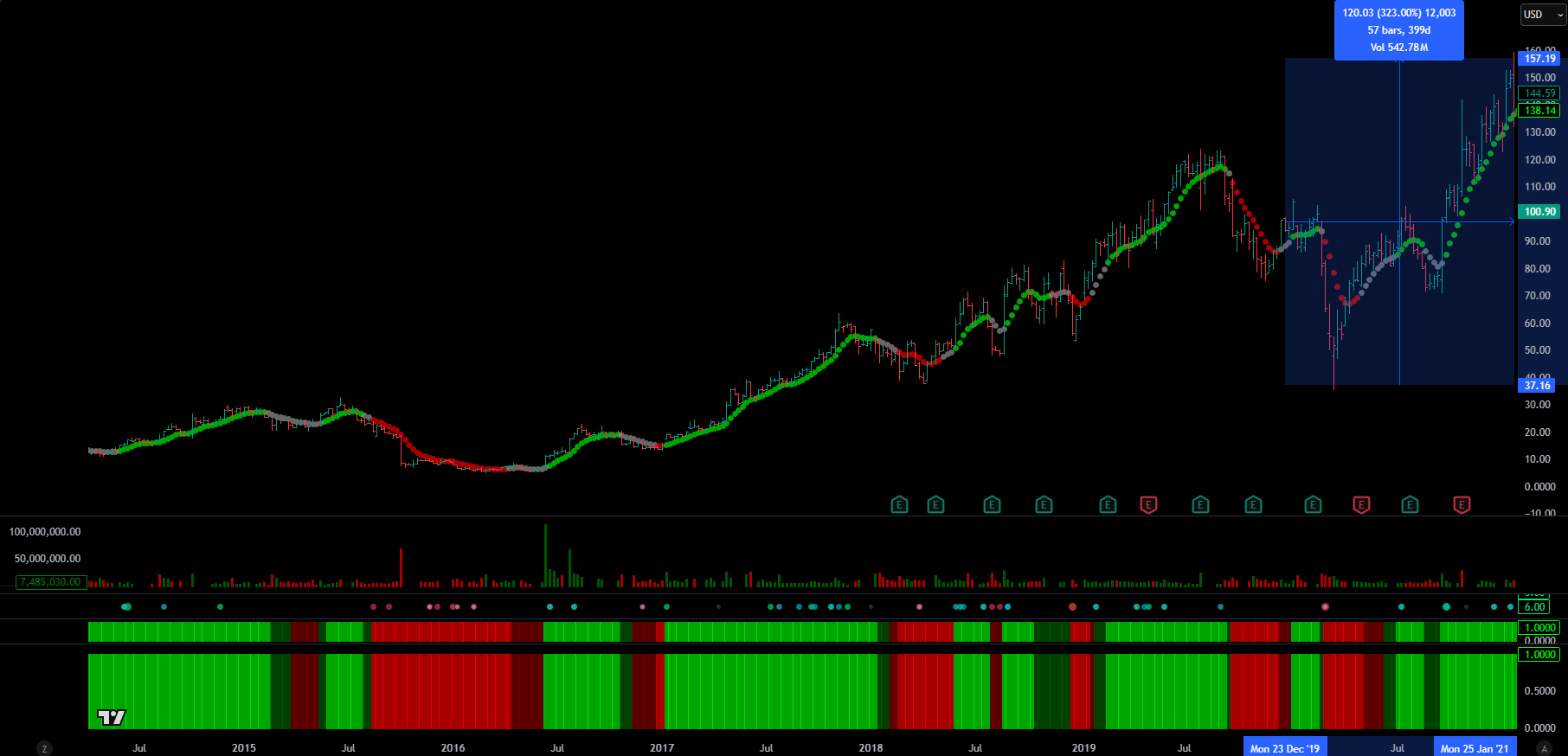

The Last Time This Exact Pattern Flashed, the Leaders Went Up 120% to almost 400 % in the Next Twelve Months

It was Q4 2020. Same “biotech is dead” headlines. Same liquid-biopsy breakout. Same tool-layer confirmation.

Guardant, Exact Sciences, and Natera delivered life-changing gains for anyone who acted before the crowd woke up.

(GH)

(EXAS)

(NTRA)

If You Still Think the Story Is “Tech vs Everything Else,” You Are About to Be Left Behind for Years

I have been documenting this rotation for paid subscribers since September.Last Sunday I said it was starting. This week the signals turned into sirens.

The megacap trade is the guy who won the lottery in 2020 and still thinks the party will last forever.

Precision diagnostics and consumer resilience just walked in wearing tailored suits, handed him the bill, and took the keys to the house.

I’ve watched this movie four times in my career.

The window never stays open longer than 6–8 weeks once the 13Fs confirm the rotation.

The market is sending a message right now, and most investors are missing it.

Premium members are not.

Here is what you unlock when you join them:

The full map of where smart money rotated this week ( and every week)

The tickers showing the strongest institutional accumulation

The tools-layer confirmations that signal a true cycle

My buy levels, targets, and risk controls

A real-time read on the rotation windows that only stay open a few week

Private market notes that never appear in the free feed

Forward-looking catalysts and timing windows

All premium updates on crypto trends, early-stage adoption waves, and asymmetric setups

Complete access to my Insider Trading research, pattern breakdowns, and high-probability screens

Want the full edge?

Upgrade to an All-In Membership and you get:

• The same software tools I use to trade with for Ninja Trader, Tradingview, Trade Station, or Meta Trader 4.If you want to stay in front of the next major move, this is the place to do it.

Join below to keep reading.

The Most Valuable Part of This Report Is Just Ahead

To continue reading this premium analysis, unlock full access below.

UpgradeUpgrade now and get the full article along with these benefits:

- Trade Setups That Work Risk-defined strategies built on insider activity, volatility behavior, momentum shifts, and liquidity dynamics.

- Macro Intelligence and Sector Rotations Early-stage insights into AI infrastructure, defense cycles, energy trends, and emerging tech opportunities.

- Priority Access to Our Best Ideas Deep-dive reports, bonus stock picks, and premium research you will not find in the free feed.