At 10 a.m. on a this quiet Friday morning, the Supreme Court may release a decision that traders have been whispering about for weeks.

Most investors think they know what happens next.

If the Court strikes down Trump-era tariffs, the story goes, markets panic. Hundreds of billions in refunds blow a hole in the deficit. Stocks sell off. Chaos follows.

That is the scary take.

It is also backward.

The real risk is not that stocks crash because tariffs are overturned. The real risk is that investors misunderstand where the pressure actually shows up next, and position for the wrong problem.

This is not a tariff story. It is a second-order effects story.

The Setup Everyone Is Watching

The case centers on whether the president can use the International Emergency Economic Powers Act to impose broad tariffs without Congress. Lower courts already ruled those tariffs illegal. The Supreme Court is now deciding whether to affirm that view, limit it, or overturn it entirely.

Prediction markets like Polymarket and Kalshi are currently pricing roughly 70% to 75% odds that the Court strikes down or meaningfully limits the tariffs, and 25% to 30% odds that they are upheld.

Markets love binaries. Reality rarely delivers them.

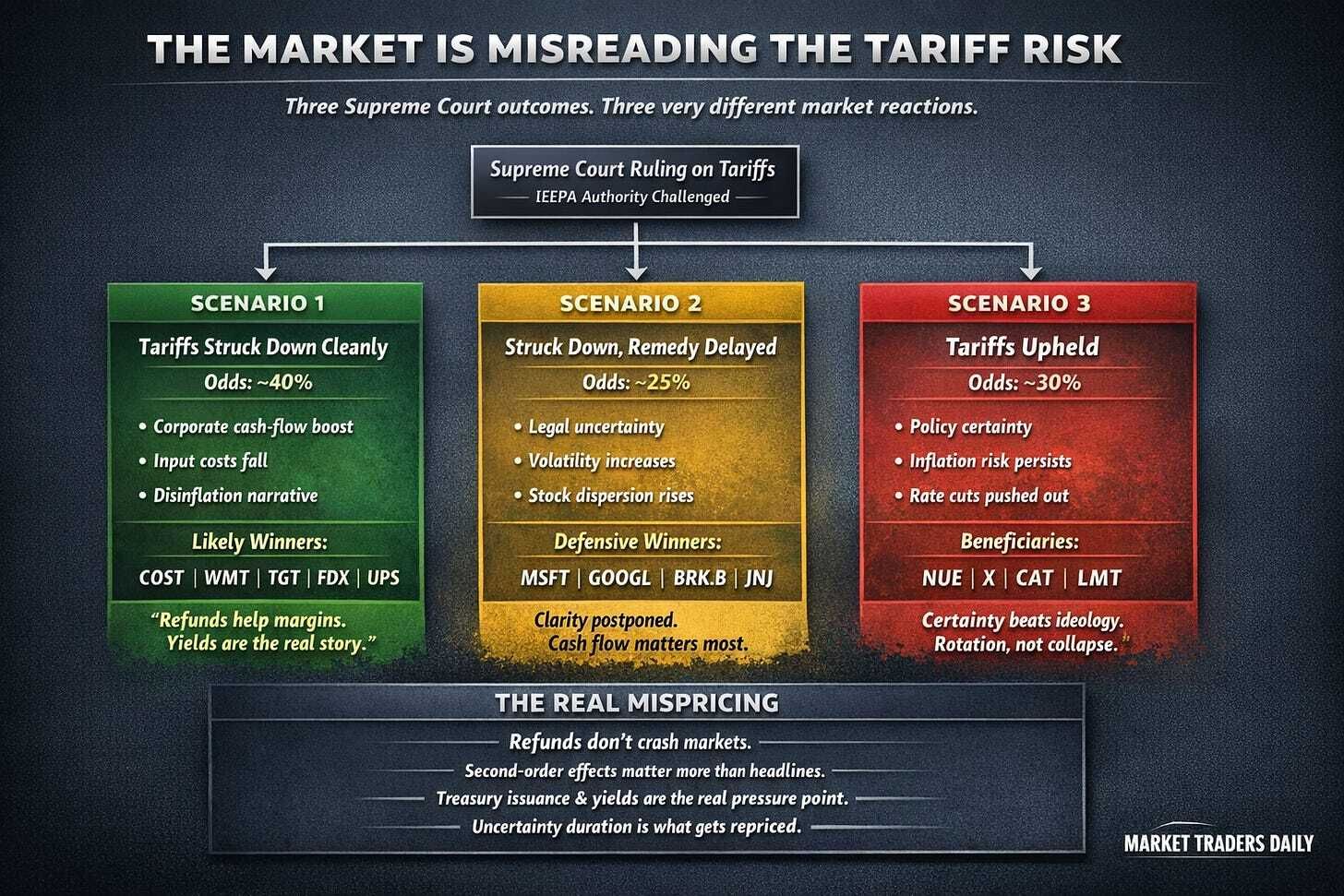

There are three realistic outcomes, and each one rewards a very different group of stocks.

Scenario 1

Tariffs Are Struck Down Cleanly

Estimated odds: ~40%

This is the outcome most people assume is bearish.

It is not.

If tariffs are invalidated clearly and refunds become likely, what actually happens is a one-time transfer of cash from the Treasury back to corporations that paid those tariffs. That is a cash-flow event, not an earnings collapse.

In the short term, this is disinflationary and margin-positive for companies that live and die by input costs.

Likely Market Reaction

Initial risk-on relief rally

Import-heavy businesses re-rate higher

Retail and logistics outperform

Rates wobble, but equities digest it well

Some Tickers That Benefit

Costco Wholesale (COST)

High import exposure and exceptional pricing power. Any cost relief drops straight to margins.Walmart (WMT)

Quiet beneficiary of lower goods inflation.Target (TGT)

Historically sensitive to margin compression. Relief here changes the narrative fast.FedEx (FDX)

Cross-border volume expectations improve.United Parcel Service (UPS)

Who Underperforms

Domestic producers who relied on tariff protection

Certain industrial materials that enjoyed artificial price floors

The irony is that the “refund shock” narrative scares investors out of stocks that actually benefit most from the ruling.

Scenario 2

Tariffs Are Struck Down, but Remedies Are Kicked to Lower Courts

Estimated odds: ~25%

This is the messiest outcome, and arguably the most realistic.

The Court rules on authority, but punts on refunds, timing, and enforcement. That leaves companies litigating claims for years.

Markets hate uncertainty more than bad news.

Likely Market Reaction

Volatility spikes

Indexes churn sideways

Stock dispersion increases

Cash flow certainty is rewarded

Some Tickers That Will Likely Hold Up Best

Microsoft (MSFT)

Minimal tariff exposure and dominant free cash flow.Alphabet (GOOGL)

Insulated from trade policy noise.Berkshire Hathaway (BRK.B)

A portfolio of optionality in uncertain regimes.Johnson & Johnson (JNJ)

Defensive earnings with limited trade exposure.

How Professionals Hedge This Outcome

Short-duration Treasuries over long bonds

Tactical volatility exposure during headline risk

Emphasis on balance sheet strength

This is where stock picking matters most.

Scenario 3

Tariffs Are Upheld

Estimated odds: ~30%

This is the least discussed outcome, and the most politically charged.

If the Court upholds the tariffs, the immediate effect is not panic. It is policy certainty. That matters more to markets than ideology.

The downside comes later, as inflation pressure remains embedded and rate cuts stay further out.

Likely Market Reaction

Rotation out of rate-sensitive growth

Dollar strength narrative reappears

Domestic industrial beneficiaries outperform

Some Tickers That Benefit

Nucor (NUE)

Tariff protection premium remains intact.United States Steel (X)

Direct beneficiary of continued trade barriers.Caterpillar (CAT)

Domestic manufacturing and infrastructure exposure.Lockheed Martin (LMT)

National security framing supports valuation multiples.

Who Suffers

Import-heavy retailers

High-multiple growth stocks sensitive to higher-for-longer rates

The Real Mispricing

The market is not mispricing tariffs.

It is mispricing how long uncertainty lasts.

Even if the Court strikes down these tariffs, the administration retains other legal tools to impose trade barriers. That means:

The policy risk premium does not vanish

Margins still matter more than narratives

Cash-flow certainty becomes more valuable than long-dated growth stories

Investors expecting a clean reset are likely to be disappointed.

The Real Edge Is Not the Headline

It’s What Insiders Do Next

Court rulings create volatility. Insider trading reveals the companies who are best set to benefit from whatever happens.

As this tariff decision plays out, we are actively tracking insider buying and selling activity across the companies most affected by each scenario. That includes the stocks highlighted in this report and many others that do not show up in headlines until weeks later.

Our premium members do not have to guess which narrative wins. We share:

Which executives are buying after the ruling

Where conviction is increasing, not just prices moving

Which moves are real, and which are just noise

What You Get When You Join The Family

When you join our paid membership, you get full access to our Insider Alerts service, including:

2–5 high-conviction insider trades per month

Each alert includes the insider activity, the setup, the catalyst, and how we are approaching it.Access to all current open trades

See exactly what we are holding, what we are watching, and how positions evolve over time.Ongoing insider monitoring on key themes

Including tariff-sensitive stocks, macro-driven rotations, and event-driven volatility like this Supreme Court ruling.Full access to all premium research and analysis

Market roadmaps, rotation breakdowns, special reports, and deep-dive articles we do not publish publicly.Real-time alerts and updates

So you are not reacting to yesterday’s news.

This is not about predicting headlines. It is about following the people with the best information once the headlines hit.

Become A Premium Member

If you want to see how insiders are positioning as this ruling unfolds, and get direct access to our best ideas in real time, you can join below.