Most investors will lose money trying to “play” the Santa Rally this year.

Not because the rally does not show up.

But because they are watching the wrong signal.

Every December, the same thing happens.

The crowd looks at charts, they debate indicators, they wait for confirmation.

Meanwhile, the people on the inside who actually know what is coming are already buying.

I’m talking about corporate insiders.

CEOs, CFOs, Board Members, people with no public information about the companies they work for.

People who see the numbers, the contracts, and the decisions long before the public ever does.

And over the last few weeks, insiders made two moves that immediately caught my attention.

It’s about positioning.

And the only place you can see that positioning early is inside SEC Form 4 filings.

The Uncomfortable Truth About the Santa Rally

Here is the part no one wants to admit.

The Santa Rally does not reward “good stories.”

It rewards forced buying.

It rewards stocks where buyers are already lined up, risk is being reallocated, and the supply of shares tightens quickly.

That is why you can have a “meh” macro backdrop and still see violent upside in the right names.

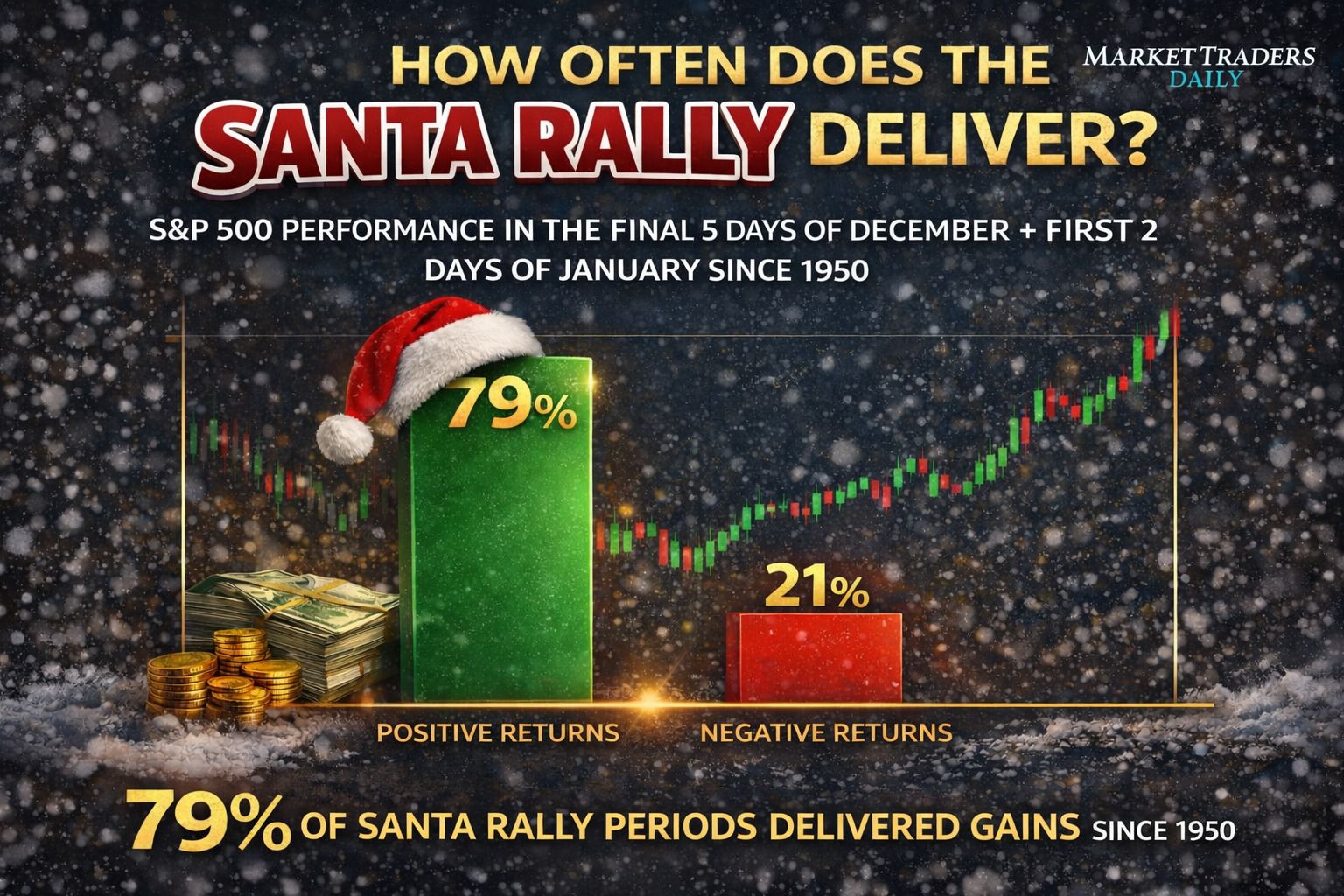

Even in messy Decembers, the Santa Rally window has historically still shown up more often than not.

So the real question is not:

“Will we get a Santa Rally?”

The real question is:

Which stocks are positioned to absorb that year-end flow like a sponge and then rip higher when the crowd shows up late?

That is where insiders come in.

While the world argues about Santa Rally trivia, the market is quietly fighting a much bigger battle.

A structural one.

Two forces are colliding.

First: the AI and automation arms race

Massive buildouts. Massive spending. And a market that is increasingly questioning which projects actually earn returns.

That tension has been a real driver of volatility into year-end.

Second: the real economy is choking on complexity

Hospitals, logistics networks, public systems, compliance stacks, and operational software are still held together with duct tape, vendor sprawl, and legacy platforms.

That complexity is no longer optional.

It is a profit killer.

So capital is being pushed toward businesses that either:

own mission-critical infrastructure and get paid no matter who wins the hype cycle, or

use automation to reset costs, expand margins, and surprise the market coming out of a downturn

The two stock I am going to share with you today fall into those categories, but this is where most investors get trapped.

They wait for the story to show up in a headline.

They wait for an upgrade.

They wait for the chart to “confirm.”

But by the time any of that happens, the insiders have already moved.

They saw the margin inflection.

They saw the contract pipeline.

They saw the cost reset from automation.

And they positioned before you ever got the memo.

The Inside Advantage Retail Can Legally “Borrow”

Here is the uncomfortable truth most investors try not to think about.

Markets do not move on indicators, they move on information.

And there is one group of participants who legally sees that information before you ever will.

Corporate insiders.

They sit inside the business while the rest of the market is guessing.

They know:

what the upcoming earnings report actually looks like

whether margins are improving or deteriorating right now, not next quarter

when a financing deal is close to being finalized

when a merger discussion is real instead of rumor

when an FDA decision is leaning yes or no

when expansion plans, contracts, or restructuring efforts are about to be announced

None of that shows up on a chart.

None of it appears in analyst notes until after the fact.

But when insiders step into the open market and buy stock with their own money, they are telling you one thing very clearly:

They believe the next public update will change how the stock is priced.

Take Planet Green Holdings, for example.

The CEO and Chief Strategy Officer each stepped into the open market and invested roughly five million dollars of their own money.

Not grants, not options, real cash.

Just days later later, the company announced a long-awaited financing agreement.

The stock exploded so fast the exchange halted trading.

Any chance they knew that the financing was going to come through?

Then there is Five Below that saw Insiders buying.

Shortly After the stock surged 384%.

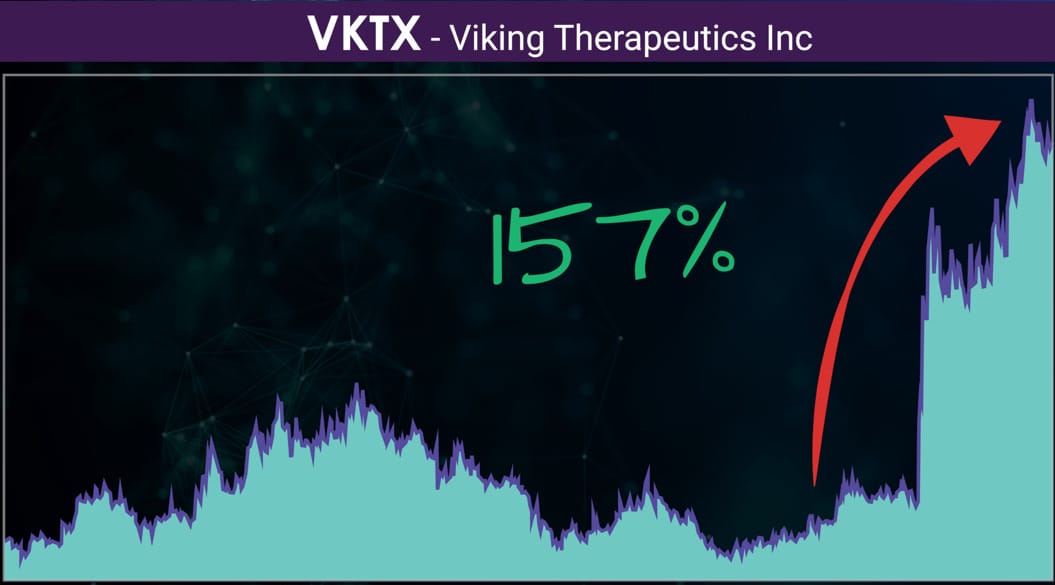

Viking Therapeutics had three board members all buying on the same day.

Forty-eight hours later, positive Phase 2 trial results were announced.

The stock jumped 157 percent in roughly two weeks.

These were not momentum trades.

They were information trades.

And the same pattern just showed up again.

This time we are seeing a rare alignment.

First a seasonal flow window where risk-on behavior can reappear quickly…

Second, volatility and narrative fatigue pushing money toward real cash and real margin expansion…

And third, Insider conviction showing up in public filings at prices you can still access.

The Two Insider-Backed Opportunities Positioned for a Year-End Surge

These are not vague ideas.

These are documented insider events, with real money, real conviction, and real asymmetry.

I’m going to show you exactly what insiders did, why it matters, and why the timing is dangerous to ignore.

Opportunity #1: The “quiet compounder” insiders almost never buy, until they do

This first stock is the kind institutions hide in when they want quality, durability, and upside without drama.

It rarely offers clean entry points because it is usually tightly held and relentlessly accumulated over time.

That is why the insider behavior jumped off the page.

After a meaningful pullback from its highs, two insiders stepped in on the same day.

The CEO bought 10,000 shares in the open market, a multi-million dollar, personal-cash purchase at prices close to where you can buy today.

A board director followed with a six-figure open-market buy at nearly the same level.

This was not routine.

This company had not seen meaningful insider buying like this in years.

When insiders who already have plenty of exposure decide to add after a pullback, it usually means one thing.

They believe the market is underpricing what comes next.

Why this matters now: year-end flows love this kind of setup. Quality names with tight supply can re-rate quickly when institutions rebalance.

If the market catches up: a simple return to prior valuation ranges puts 20–30% upside on the table on the equity alone, with long-dated options offering significantly more if the re-rating plays out over the next 6–12 months.

Quiet trades like this do not stay quiet forever.

Opportunity #2: The “left-for-dead” stock insiders bought at the lows, right before the crowd wakes up

This one is the opposite.

It was hated.

Dumped.

Left for dead.

The kind of stock people stop mentioning because it is painful to even look at the chart.

That is exactly when insiders stepped in.

And not with token buys.

With the kind of behavior that tends to show up right before the first violent repricing move.

The CEO bought nearly 180,000 shares in the open market.

A senior executive followed with a meaningful additional purchase at nearly the same price.

These were first-time cash buys, the kind that rarely happen unless something inside the business has changed.

This is what most investors miss.

First-time buyers do not wake up one day and decide to throw real money at a broken stock for fun.

They act when the internal reality is about to diverge from the public narrative.

In this case, that divergence is coming from a cost reset.

Automation is changing throughput, labor intensity, and margin potential.

The market is still pricing the old version of the company.

Insiders bought the new one.

Now add the year-end backdrop.

When liquidity improves and risk appetite returns, beaten-down names like this can snap back hard, especially when insiders have already planted their flag near the lows.

This is where the “I’ll wait for confirmation” crowd gets punished.

Because by the time the story feels safe, the stock is already gone.

If the thesis plays out: reclaiming prior resistance puts 50–70% upside on the table on the equity in fairly short order, with properly structured options capable of 3–6x if the repricing move accelerates.

The Full Alert And Trade Plan

The complete breakdowns on both of these opportunities are available to all Market Traders Daily Premium Members.

That means the full story, not the watered-down version.

You will see:

the insider filings and why the buying is so compelling

whether it was a cluster buy, first-time buyer, or rare conviction purchase

exact buy zones, buy-up-to levels, and risk lines

upside targets and catalyst maps for the next 30 to 90 days

You are not joining for stock tips.

You are joining for a repeatable signal and a clear plan.

What Premium Members Get Every Month

As a Premium Member, you get two engines working together.

Insider Report

Two to five full write-ups per month on stocks with the best odds of success after insiders buy.

Each includes:

Form 4 analysis

conviction filters

trade structure and options overlays when appropriate

This is the core edge.

Market Traders Daily

You also get:

rotation emails and positioning notes

stocks to watch and trade with levels

macro context so you avoid getting chopped up

This is the full operating system we use to navigate markets.

The Christmas Season Offer

Normally, we charge $1,997 per year for the Insider Report alone.

We almost never discount it. We almost never offer monthly access.

But during the Christmas season, for a limited time, you can get started as a Premium Member for:

Just $1997 $97 per month

That includes immediate access to:

the two insider-backed opportunities

ongoing Insider Report alerts

Market Traders Daily rotation guidance

The Final Loop

Here is what happens next.

Either you keep playing the same December game everyone else plays.

Or you step into the edge that shows you what the smartest participants are doing with real money, in real time.

Insiders already placed their bets.

The filings are public.

The window is open.

All that’s left is whether you take the same trades before the crowd arrives, or after.

The Most Valuable Part of This Report Is Just Ahead

To continue reading this premium analysis, unlock full access below.

UpgradeUpgrade now and get the full article along with these benefits:

- Trade Setups That Work Risk-defined strategies built on insider activity, volatility behavior, momentum shifts, and liquidity dynamics.

- Macro Intelligence and Sector Rotations Early-stage insights into AI infrastructure, defense cycles, energy trends, and emerging tech opportunities.

- Priority Access to Our Best Ideas Deep-dive reports, bonus stock picks, and premium research you will not find in the free feed.