The Next 12 Months Won’t Be Led by the Names Everyone is Still Obsessed With

This week, Wall Street finally showed its hand.

While retail traders panicked over the latest tech wobble, the smartest funds in the world doubled down on three sectors tied directly to real demand, real cash flow, and the industrial backbone of the AI economy.

Very few people noticed.

But if you follow where the capital actually flowed — not where the headlines point — a new market regime is already here.

And it’s moving fast.

The Market Is Rebuilding the Real Economy Beneath the AI Hype

Everyone keeps talking about AI software and models.

But the real money is pouring into the companies that make AI physical:

• Robotics that run warehouses

• Metals needed to build chips and power grids

• Cash-rich consumer winners the economy can’t function without

No memes. No hype halos. No “number go up” fantasies.

This is demand driven by infrastructure, not influence.

AI Robotics: The Buildout Begins

Companies powering logistics automation and warehouse intelligence are accelerating right now, before the masses catch on.

Symbotic (SYM) continues to show a breakout pattern only seen when institutions are in accumulation mode.

Revenue growth north of 100 %.

Contracts from mega-retailers piling up.

This is the hardware side of AI — the one Wall Street forgot to price in.

Hard Assets: The Scarcity Trade Isn’t Waiting for Permission

Silver and copper refused to budge lower even as the market wobbled.

That’s hedge funds and global macro desks placing Q1 bets.

Names like Endeavour Silver (EXK) and leading miners quietly gained while attention stayed glued to tech volatility.

AI can’t run on hope.

It runs on electricity and metals.The Final Door Opens Soon

Selective Staples: The Survivor Class Rises

While economists argue over the “death of the consumer,” a very different truth is emerging.

Consumers aren’t broke.

They’re selective.

They’re rewarding companies that deliver:

• High repeat purchases

• Sticky demand

• Real profit margins

Brinker (EAT).

Vita Coco (COCO).

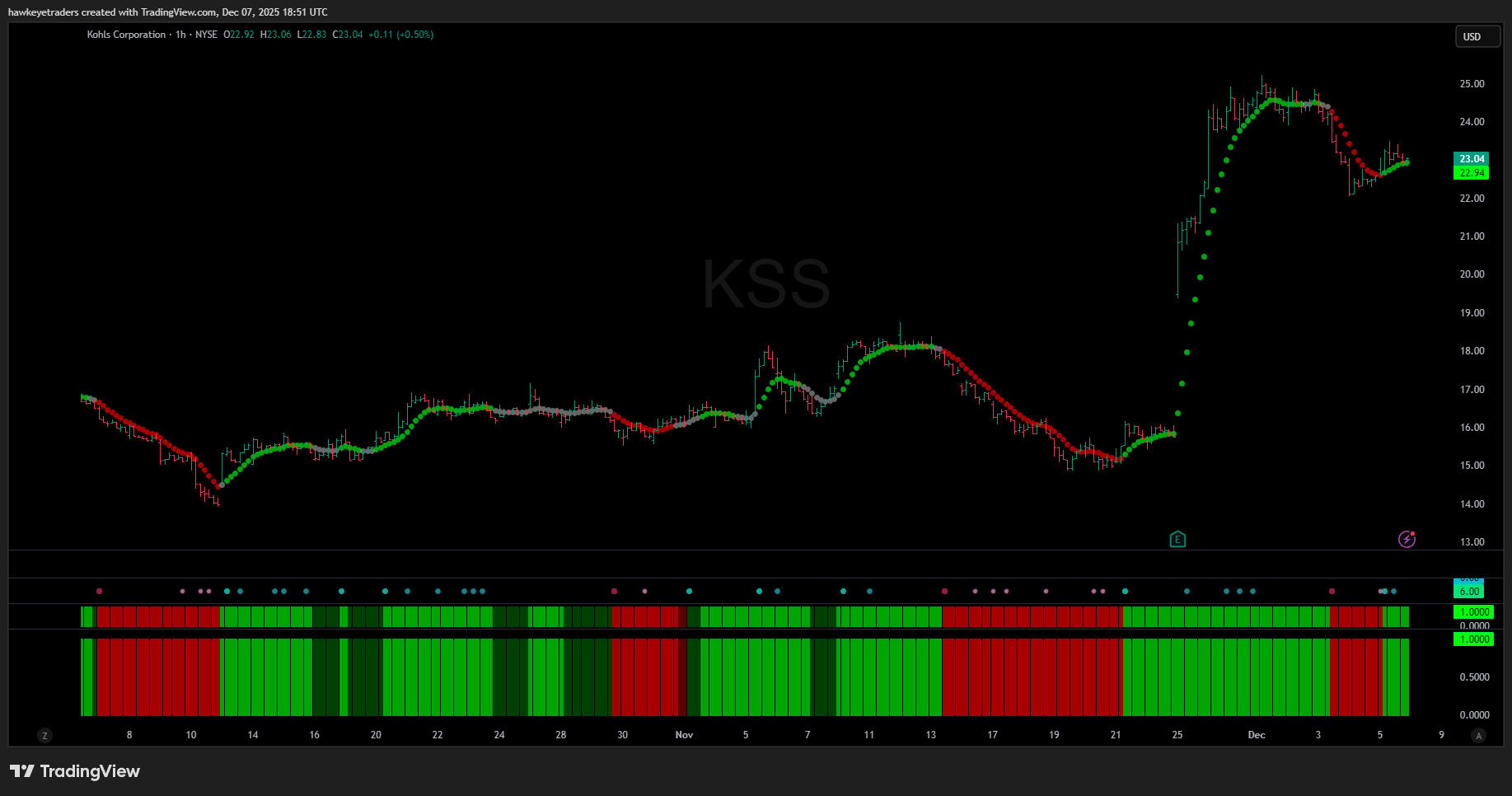

Kohl’s (KSS).

All stronger today than before the rate shock.

Tech Isn’t Dead. It’s Just Not the Hero Anymore.

For 18 months, the market survived on the backs of a tiny group of megacaps.

That era is ending.

Breadth is widening.

Leadership is rotating.

And the names that actually build the future, not advertise it, are finally getting the bid.

If you position early, the upside can be exponential. If you wait for CNBC to validate it, the move will be gone.

Here’s the Tell No One Is Talking About…

The exact rotations we’re seeing today are the same fingerprints we saw:

• Before robotics took off in 2016

• Before precision diagnostics surged in 2020

• Before energy and metals ripped in 2022

These aren’t random pops.

They are institutional positioning signals.

And they almost always lead — months before the headlines do.

You’re Seeing This Early — On Purpose

If you’re reading this, you’re already ahead of:

• Financial media

• Retail algorithms

• Anyone relying on lagging data

And right now, early matters.

Because when leadership changes… fortunes change with it.

Paid subscribers receive the full breakdown of this week’s highest-conviction rotation names, exact buy zones, and risk levels — including the 5 stocks that absorbed the lion’s share of institutional flow.

Upgrade to unlock the detailed playbook behind this move before it becomes obvious.

The Most Valuable Part of This Report Is Just Ahead

To continue reading this premium analysis, unlock full access below.

UpgradeUpgrade now and get the full article along with these benefits:

- Trade Setups That Work Risk-defined strategies built on insider activity, volatility behavior, momentum shifts, and liquidity dynamics.

- Macro Intelligence and Sector Rotations Early-stage insights into AI infrastructure, defense cycles, energy trends, and emerging tech opportunities.

- Priority Access to Our Best Ideas Deep-dive reports, bonus stock picks, and premium research you will not find in the free feed.