By the time Powell steps to the microphone this afternoon, most of Wall Street will already be wrong.

They will be fixated on the headline.

Did the Fed cut a quarter point or not

How many cuts are penciled into the dot plot

Which adjectives Powell chose for the prepared remarks

In other words, they will obsess over the theater.

What actually matters for your money is something far more basic and far more powerful:

Is the Federal Reserve draining liquidity from the system, or quietly adding it back in.

This Substack is reader-supported. To receive new posts and support my work, consider becoming a free or paid subscriber.

We are very close to a moment that only comes around a few times per cycle.

A point where the direction of liquidity flips.

And if you understand how that flip works, you will know why some corners of the market are about to become very dangerous, while others are setting up for the kind of multi-year runs that can rewrite your net worth.

Most investors will miss it completely.

You do not have to be one of them.

Everyone Is Arguing About The Wrong Thing

If you flip on financial TV today, you will hear the same tired script.

One camp says the Fed is “behind the curve” and needs to cut aggressively.

The other says inflation is still too high and the Fed “cannot afford” to ease.

Both sides want to drag you into a political argument.

Here is the problem.

The market already made its judgment long before Powell opens his mouth.

Futures have been pricing a path of cuts for months

Curves have already steepened and then flattened again in anticipation

Credit markets have quietly shifted how they price growth and default risk

In other words, by the time we get the press conference, most of the easy reaction trade in the front end of the curve is already gone.

What is not priced in yet is how this all plays out over the next 12 to 24 months now that the Fed has effectively stopped draining the pool.

Because while everyone was yelling online about “higher for longer,” something important already changed in the plumbing.

Quantitative tightening is ending.

QT Just Ended. That Changes The Game.

For the last couple of years, the Fed has been shrinking its balance sheet.

That is the part of policy almost no one talks about at cocktail parties, yet it is the one that often matters most to markets.

Here is the simple version:

During QE, the Fed was buying bonds and pushing fresh reserves into the banking system

During QT, the Fed was letting bonds roll off and pulling those reserves back out

Think of QE as opening a fire hose into financial markets.

Think of QT as closing the valve and letting the excess drain into the floor.

We have been in that draining phase.

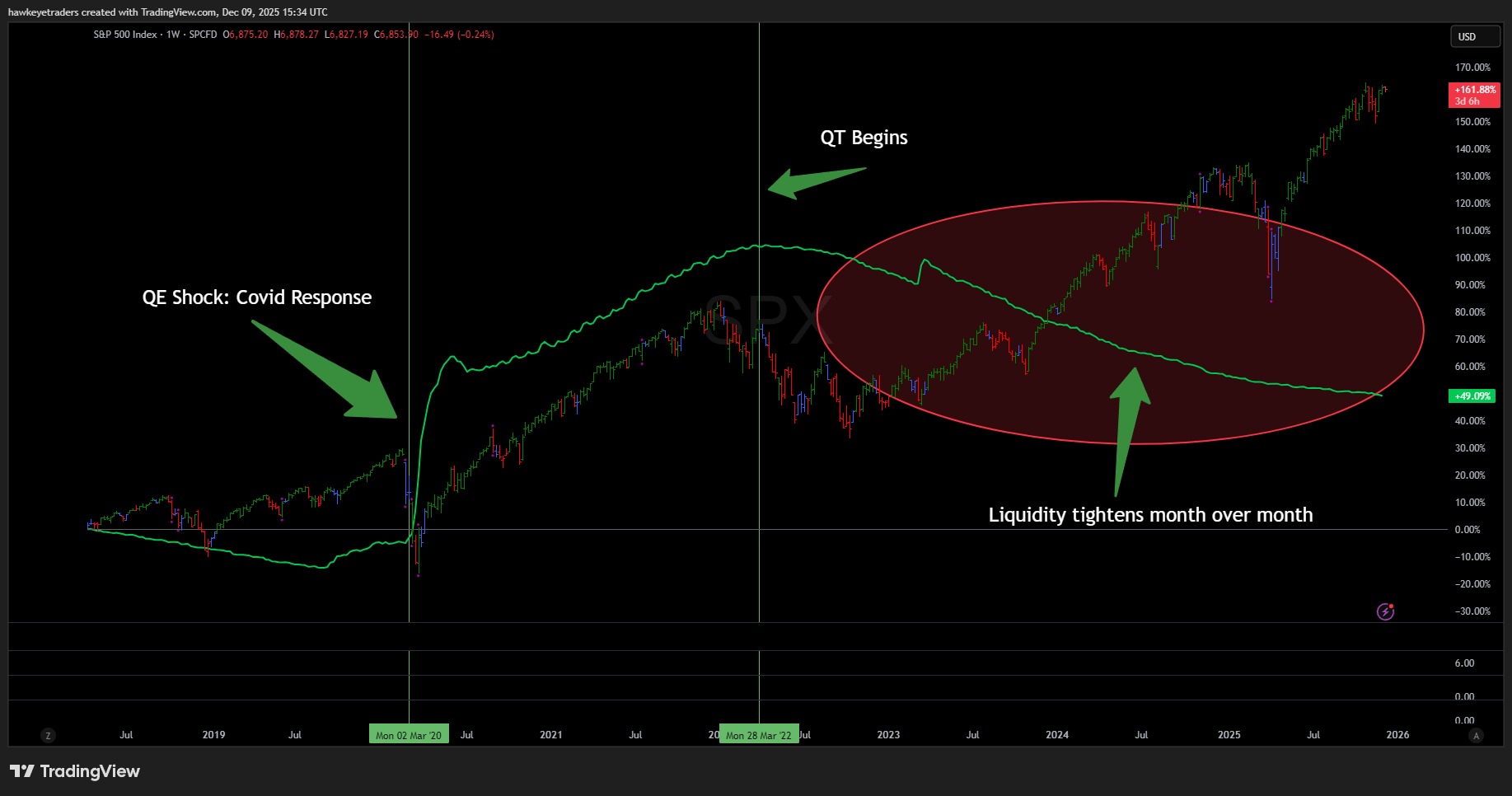

The green line in the chart below is the Fed’s balance sheet. It explodes higher in 2020 when QE hits, tops out in mid-2022, and then quietly rolls over. From that peak forward, the Fed has been shrinking its balance sheet almost every month, even as the S&P candles keep marching to new highs.

Now we are at the pivot point.

The Fed has effectively stopped shrinking the balance sheet and started talking about “reserve management” again.

They do not want to call it QE.

They will not stand up and say “we are printing money.”

Instead, they will dress it up in technical language.

You will hear phrases like:

“Ample reserves”

“Smooth functioning of money markets”

“Reinvestment of maturing securities”

Translated: they are done yanking liquidity out of the system and are laying the groundwork to keep it abundant.

It does not sound dramatic, which is exactly why most investors will ignore it.

But if you look at how markets behaved the last time QT ended, you will understand why this moment matters.

What A Liquidity Flip Usually Does To Markets

When the Fed shifts from active draining to neutral or gently adding, the effect is rarely instantaneous.

You do not wake up tomorrow to a straight line higher.

Instead, liquidity moves through the system in stages.

First, the stress points ease.

Dollar funding pressures calm down

Certain credit spreads stop widening and begin to grind tighter

The wildest volatility in rates settles into smaller, tradeable ranges

Then the “liquidity sponges” start to respond.

These are the parts of the market that soak up every extra unit of easy money.

Speculative tech

Leveraged players

Crypto and miners

Crowded carry trades that suddenly feel safe again

They do not all move together, and they do not all survive the full cycle.

Some become the next big winners.

Others become the next spectacular blowups.

Finally, once enough investors realize the regime has changed, capital starts to rotate.

Out of assets that only made sense in a world of artificial scarcity.

Into assets that can actually compound in a world where capital is getting cheaper again.

That is the phase that produces the biggest long term winners.

It is also the phase that almost no one prepares for ahead of time.

The Collision Course In December

Why does this matter today of all days

Because we are heading into one of the most crowded months of cross-currents I have seen in years.

On one side, you have the Fed.

A likely move toward cuts over the next year

An end to active balance sheet runoff

The first hints of quiet bill buying and reserve management

On the other side, you have a packed calendar of real world market events.

In crypto, December is loaded with:

Big token unlocks that dump supply into the market

A halving event that cuts emissions for one of the most talked-about AI tokens

Upgrades on major chains that change how capital flows across L2s

At the same time, in traditional markets, you have:

Energy and hard assets still trading at clear discounts to fair value

Certain high quality cash generators priced as if money will stay scarce forever

Hyper-crowded “AI darlings” that already baked in years of perfection

That is what happens when you slam a monetary turning point into a month full of catalysts.

Liquidity that was scarce becomes less scarce.

Supply that was manageable becomes less manageable.

Traders who have been on one side of the boat all year suddenly realize the water level is changing beneath them.

And because most of them are watching the wrong dial, they are likely to be late.

Where The Real Opportunity Lives

If you are thinking like a serious investor, the question you should be asking this morning is not:

“Will the Fed cut 25 basis points today”

The question is:

“If the direction of liquidity has quietly flipped, which parts of the market are the most mispriced for a 2026 world”

I believe the opportunity breaks into three buckets:

Assets that become safer as liquidity improves, because they were never priced for perfection in the first place

Assets that can channel cheap capital into real, measurable cash flows

Assets that are pure speculation and only make sense if the fire hose turns back on at full blast

Most of the content you will see today will treat them all the same.

Everything will be framed as “risk on” or “risk off.”

That is how you end up buying the wrong things at exactly the wrong time.

My hope is that this article will help you to tell the difference.

Which brings us to the part of this report you will not hear about on TV.

The specific ways I am positioning as this liquidity flip takes hold.

Before we get to the details, including the exact names on my watchlist and the levels I am using, I want to be very clear about something.

This is The Most Valuable Part Of This Report

and is for subscribers only. It breaks down how I am turning all this information into actual trades. When you subscribe below for FREE, you immediately unlock:

✅ Real Trade Setups That Work

I share concrete, risk-defined trading setups built around this liquidity flip, including how I am using insider activity, volatility shifts, and rotation signals to time entries and exits.

✅ Macro Intelligence You Can Actually Use

You get my ongoing read on the Fed, credit spreads, and global liquidity, plus how those forces are pushing capital into or out of specific sectors like energy, robotics, and crypto infrastructure.

✅ Priority Access To My Best Ideas

Early access to deep-dive reports, bonus stock picks, and premium research collaborations that never appear in the free feed.

If you want to see which assets I believe are best positioned to benefit from this liquidity flip, along with my buy zones, targets, and risk controls, now is the time to upgrade to premium and read the rest of this report.