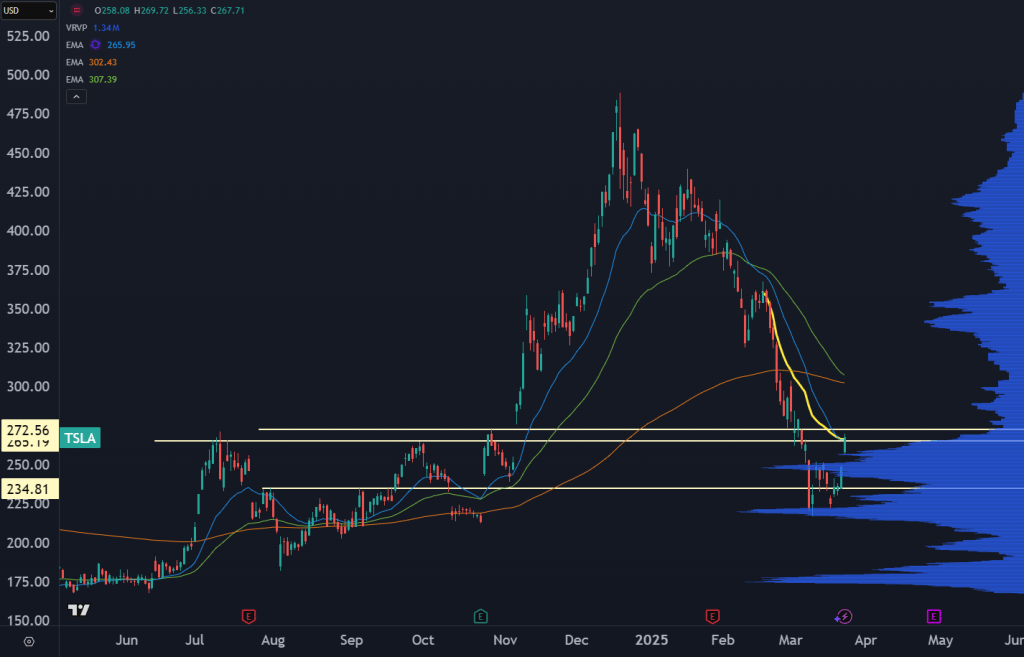

What a wild ride on this one!

Our first entry was solid in a "normal" market, but then the stock got absolutely killed. I don't think it has anything to do with politics, or Teslas burning, or anything about the company specifically.

It was because of this:

This chart is the relative performance of TSLA and the Nasdaq 100.

What happened was there was a trading pod, or hedge fund, or a group of players all running the same convergence trade, where they got long TSLA and short QQQ

And the trade blew up.

Much of the move was related to the options market, and now that we are on the other side of March opex, the same dynamics that caused a massive push lower are no longer there.

That being said, we are back to our original entry price on the equity, and we can take some risk off the table. I'm looking for the stock to develop a kind of high volatility trading range, which is what tends to happen after the stock gets crushed, and we can trade around our call options to take advantage of that move.

The Most Valuable Part of This Report Is Just Ahead

To continue reading this premium analysis, unlock full access below.

UpgradeUpgrade now and get the full article along with these benefits:

- Trade Setups That Work Risk-defined strategies built on insider activity, volatility behavior, momentum shifts, and liquidity dynamics.

- Macro Intelligence and Sector Rotations Early-stage insights into AI infrastructure, defense cycles, energy trends, and emerging tech opportunities.

- Priority Access to Our Best Ideas Deep-dive reports, bonus stock picks, and premium research you will not find in the free feed.