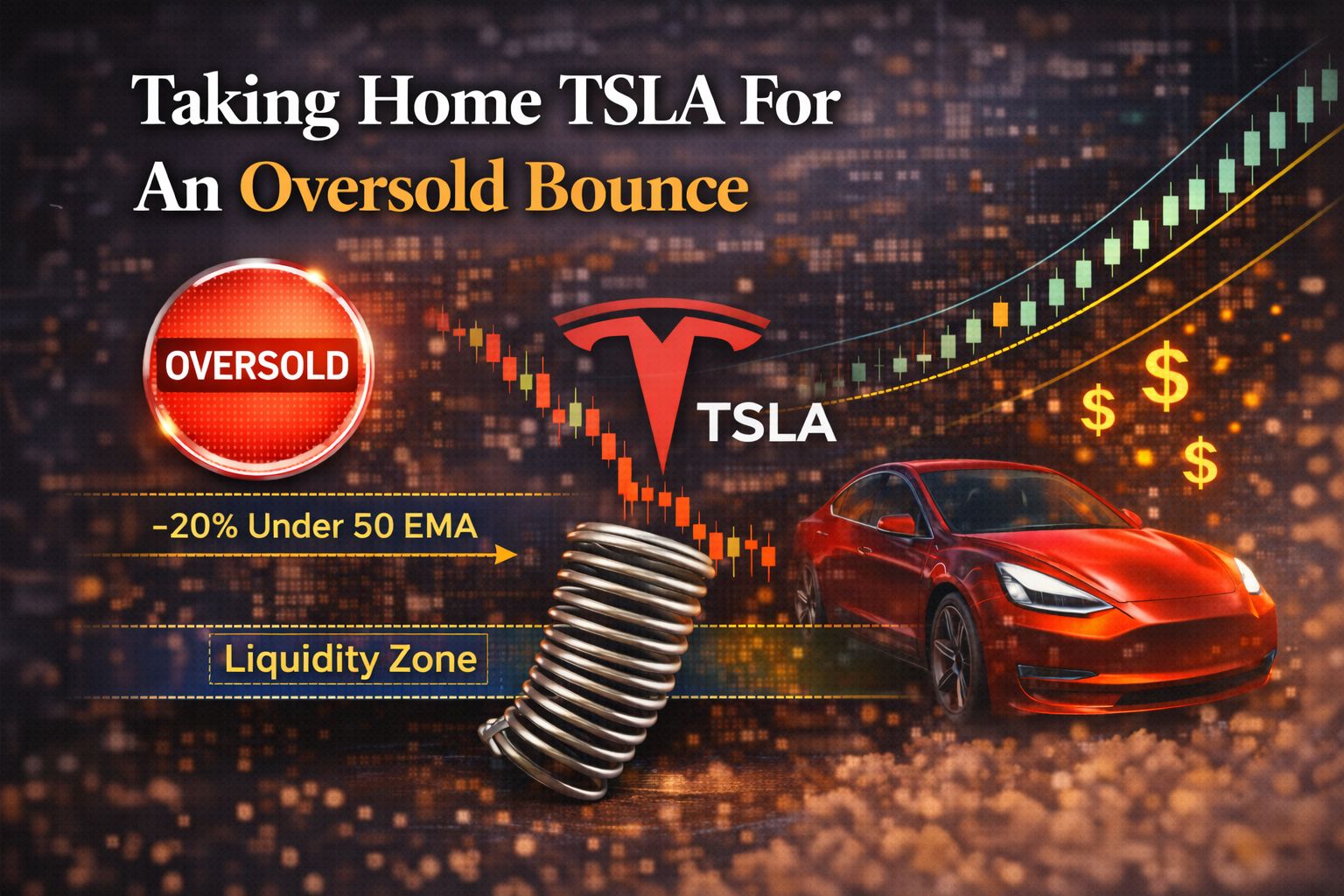

TSLA is now approaching an important "oversold" reading.

The stock is currently 20% under its 50 EMA, which is about where a full reset occurs.

Now there has been a ton of weakness in the markets, and tech specifically, yet many of these names are coming into bigger levels.

Assuming the volatility market doesn't blow out due to a fund being inappropriately positioned, we should have a bounce in store.

Another highlight from the chart:

TSLA is approaching a big liquidity zone. The full point of control is down around 250, and I have a very important zone marked just underneath that at 248.

We are picking a bottom, and that can end up being imprecise, as a fund can just blowout of a position.

That's why we are going to focus on options only, and use a scaling method that takes advantage of the liquidity in the markets.

The Most Valuable Part of This Report Is Just Ahead

To continue reading this premium analysis, unlock full access below.

UpgradeUpgrade now and get the full article along with these benefits:

- Trade Setups That Work Risk-defined strategies built on insider activity, volatility behavior, momentum shifts, and liquidity dynamics.

- Macro Intelligence and Sector Rotations Early-stage insights into AI infrastructure, defense cycles, energy trends, and emerging tech opportunities.

- Priority Access to Our Best Ideas Deep-dive reports, bonus stock picks, and premium research you will not find in the free feed.