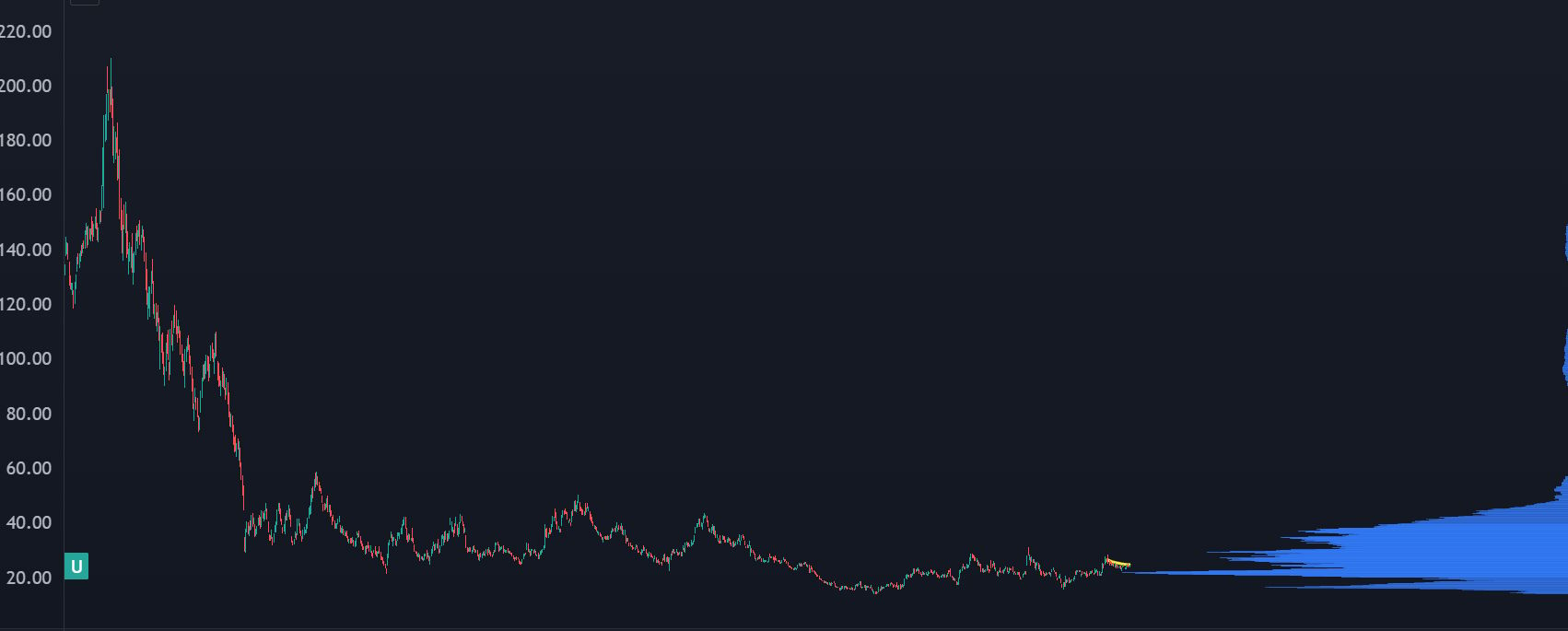

Unity software is a former high-flying momentum stock that came down to Earth in 2022 and has been stuck in a range for multiple years.

It's been a tough slog for the company. They changed pricing of how their software works, and it caused an open revolt from their developers and the board of directors. They also got entirely too acquisitive and many of their deals had to get processed through the stock as the company started to "right-size."

Throughout this basing pattern, a new point of control (POC) has developed for the stock:

It's not just the pivot lows from 2023, it's where the majority of shares have traded as the stock has built out a range.

The most recent pullback has the stock holding the upper edge of this POC, which is a signal that buyers are stepping up and adding:

There's been some institutional call option flow over the past few months, and this is a good place to have an anticipatory buy.

One more thing about the company, they are about to hit some narrative tailwinds.

As they are a game development engine, they have just pivoted into "Unity AI" which is providing an AI assistant for code generation, asset creation for games, and an agent to help people make games faster.

The beta for the software just came out this month, so the hype behind the launch could show up as Wall Street discovers another company that has an "AI Layer Value Unlock."

Similar to what happened with RBLX:

The Most Valuable Part of This Report Is Just Ahead

To continue reading this premium analysis, unlock full access below.

UpgradeUpgrade now and get the full article along with these benefits:

- Trade Setups That Work Risk-defined strategies built on insider activity, volatility behavior, momentum shifts, and liquidity dynamics.

- Macro Intelligence and Sector Rotations Early-stage insights into AI infrastructure, defense cycles, energy trends, and emerging tech opportunities.

- Priority Access to Our Best Ideas Deep-dive reports, bonus stock picks, and premium research you will not find in the free feed.