Before we get into today's setup, there are some bigger macro risks currently hitting the biotech and pharma space. Here's a look at the UST 10 Year yield:

Rates are continuing to creep up higher, coming into a "warning zone" where narrative shifts start to happen if we bust above 5%. There will most likely be an attempt by the markets to push to that level as we come into the new Presidential administration.

High rates make it difficult for biotech stocks to operate. Drug trials take time and money to complete, and financing is tougher to come by when investors can get better risk-adjusted returns on USTs, or they may pass on offering financing alltogether because the cash flow needed to finance corporate debt may not be a long enough runway for the company to get through FDA trials.

XBI is an exchange traded fund that tracks the biotech sector, and you can see that through the entirety of 2024 there was a failure to launch and breakout above $100:

The sector is coming down to a key low volume node around 85-86 that I expect to be a good bounce spot, and will most likely line up with support hitting in treasuries and smallcaps.

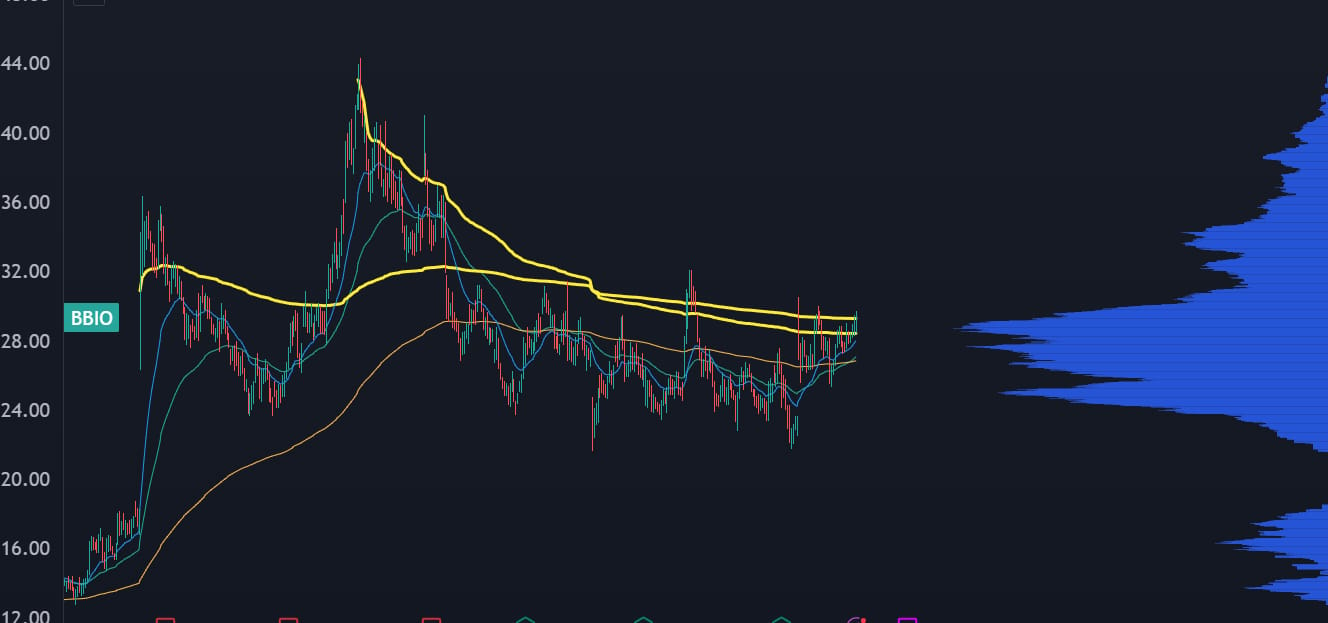

During this entire mess, we're seeing a strong bid in BBIO:

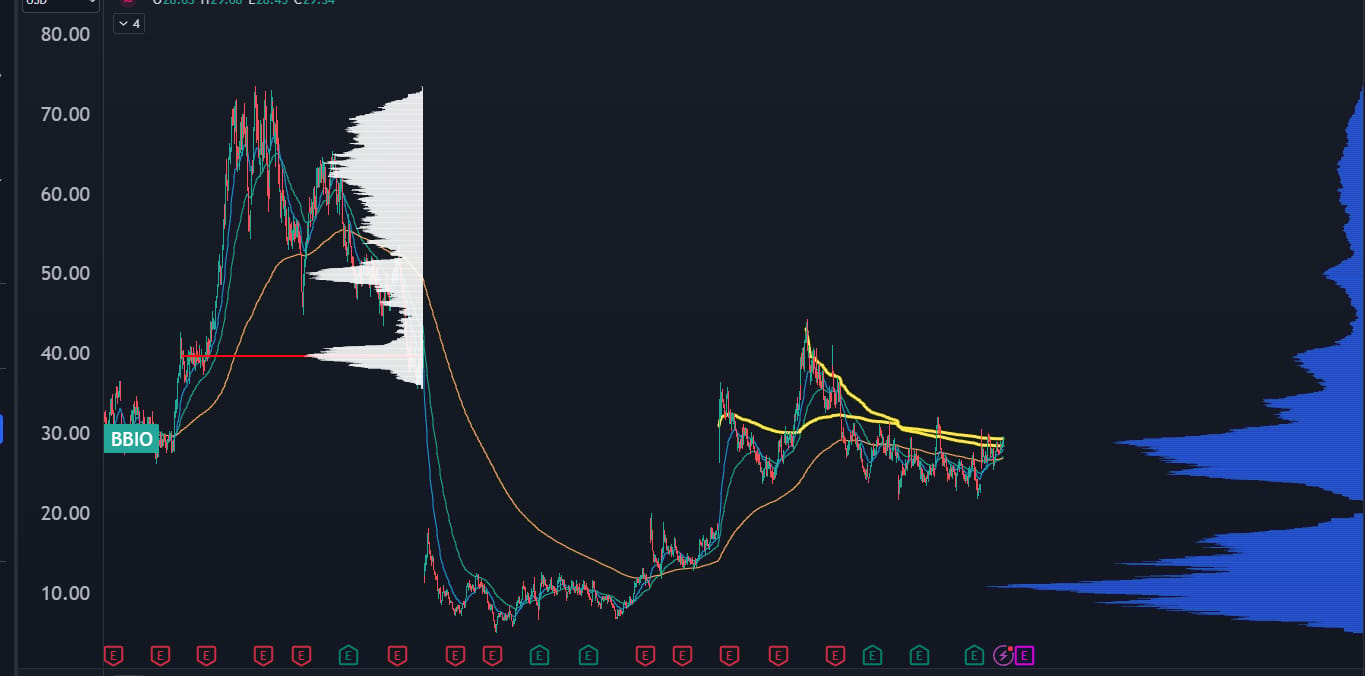

The company saw a catalyst back in November, with FDA approval of Attruby following good Phase 3 trials. The stock attempted to fill that gap, but was halted twice at a key low volume node (LVN) shown by the red arrow.

This is a company that is on several buyout watchlists, and there has also been some option flow in the May 30 calls and a few other strikes/durations.

The relative strength against the biotech sector, combined with a hold of price levels after FDA news, suggests that it is set to clear out of the 2H2024 trading range.

The stock is starting another attempt to clear above the swing AVWAPs from the Aug 2023 breakout, and the all time highs.

Backing out a little bit, we can see that the stock had a run in 2021 with the rest of biotech, but got clobbered on different FDA news.

A look at that liquidity structure shows the "bagholder point of control" is at $40, which should act as a magnet into the breakout.

The Most Valuable Part of This Report Is Just Ahead

To continue reading this premium analysis, unlock full access below.

UpgradeUpgrade now and get the full article along with these benefits:

- Trade Setups That Work Risk-defined strategies built on insider activity, volatility behavior, momentum shifts, and liquidity dynamics.

- Macro Intelligence and Sector Rotations Early-stage insights into AI infrastructure, defense cycles, energy trends, and emerging tech opportunities.

- Priority Access to Our Best Ideas Deep-dive reports, bonus stock picks, and premium research you will not find in the free feed.