The big news in tech this week was the Deepseek drop. This is an AI that came out of China and is purported to be a model with very low costs to build. As more time goes on, some of their claims seem to be rubbish, but it is an open source model that anyone can replicate to see if it works.

While everyone has been focusing on the implications for NVDA, consider how the commodification of AI is going to help software stocks build out features faster and cheaper. This helps with margins and cash flow, and some names that have been "dead money" for over a year are starting to catch some upside here.

Asana (ASAN) is one of those plays.

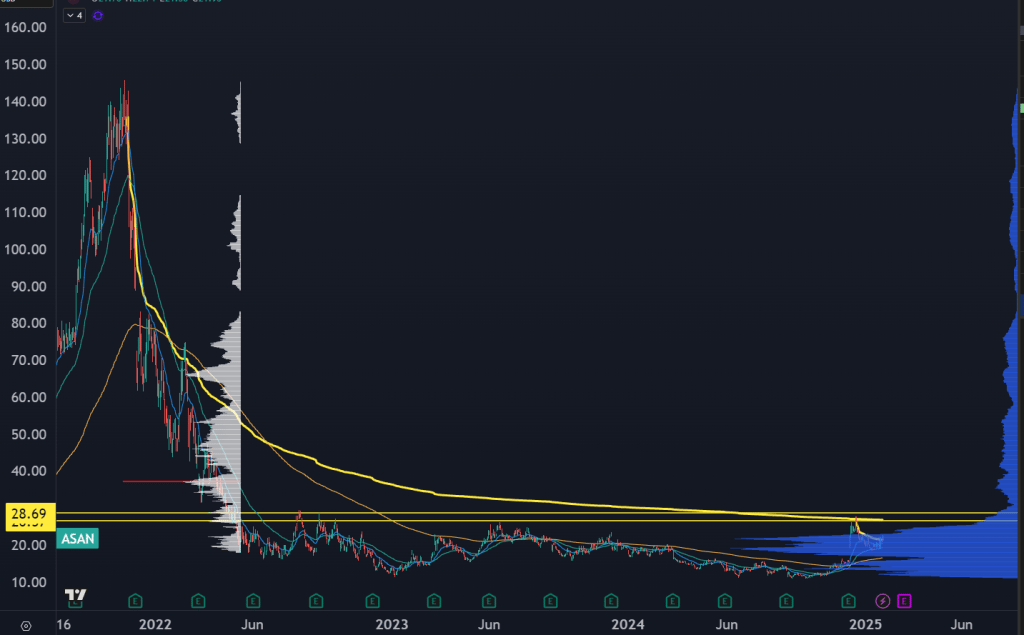

After peaking above $140 during the 2021 bubble, the stock got absolutely murdered and has been in a trading range between $12 and $27 for over two years. The company has been trying to manage a turnaround as they are in the "tech services" industry, and if tech doesn't want to (or can't) spend on enterprise software, then they will take a hit.

That all changed with the most recent earnings report. They had a big beat on earnings, launched an AI product, and guided for positive FCF going into Q4. They also saw YoY rev growth, and appear to be on the path of a bigger turnaround.

Into that earnings, the stock jammed into the swing AVWAP from the all time highs and found some sellers right there. But instead of doing a full round trip of the earnings gap fill, it found support with the rising 50 EMA, twice, and has just cleared the AVWAP from the recent swing highs.

This appears to be a good spot to anticipate the breakout-- instead of chasing the 28 breakout, we "pre-load" at lower prices.

My first target is going to be the Point of Control from the 2021-2022 selloff, right around $37. And the options are underpricing this upside potential, which is what we're going to take advantage of.

The Most Valuable Part of This Report Is Just Ahead

To continue reading this premium analysis, unlock full access below.

UpgradeUpgrade now and get the full article along with these benefits:

- Trade Setups That Work Risk-defined strategies built on insider activity, volatility behavior, momentum shifts, and liquidity dynamics.

- Macro Intelligence and Sector Rotations Early-stage insights into AI infrastructure, defense cycles, energy trends, and emerging tech opportunities.

- Priority Access to Our Best Ideas Deep-dive reports, bonus stock picks, and premium research you will not find in the free feed.