Before we get into the company's narrative, take a look at the base that has built out. There is an incredibly strong "point of control" that has been building for three years.

A lift from this gets the prior pump levels in play up at $15.

It's a straightforward POC breakout, but there are some very cool stories that the company could latch onto as we move into the "applied AI" theme in the markets.

Recursion Pharma is a biotech platform play. That means instead of focusing on an individual drug, they have a proprietary software platform that helps them do drug discovery.

It's Pharma AI.

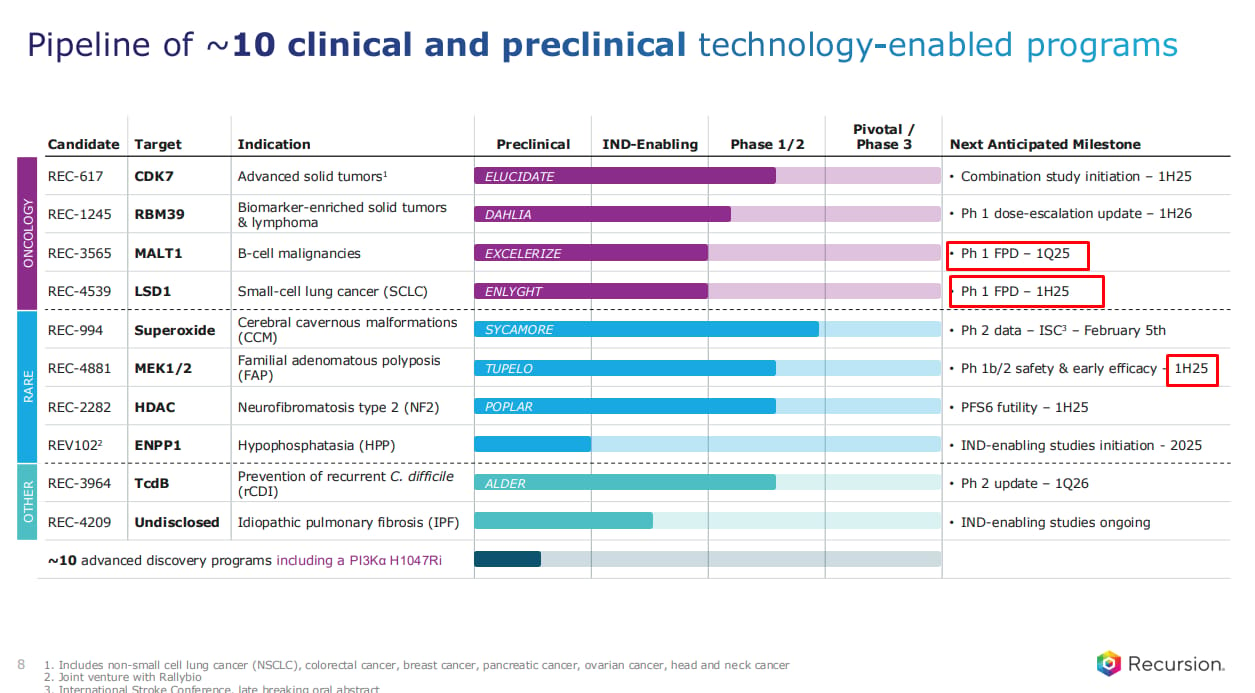

Here is their pipeline:

Note that there are a few FDA catalysts that are up on deck for the next few months.

Here's some other considerations about the company:

using a software platform to develop drugs drastically reduces the time and cost of getting new drugs into an FDA pipeline. Not only does this give investors faster upside, it means they can continue to secure funding to help test these new drugs.

Last year they created BioHive-2, the largest supercomputer in the pharma space

AI discovered drugs are going to come out of left field with respect to our expected knowledge. It's like comparing early prototypes of air flight vs a learjet now

The platform may be more valuable than the drugs themselves, making them a viable buyout target

Plenty of narrative tailwinds can help this stock finally get liftoff.

The stock has had a tough time holding above $8:

This is an hourly chart of the stock. Every attempt to push above $8 (and the 200 EMA) has been met with sellers, but the bid continues to march higher, forming higher lows. If marginal sellers clear out and the stock pops and holds $8, you'll see momentum chasers light this on fire and get a solid rally for the stock.

The Most Valuable Part of This Report Is Just Ahead

To continue reading this premium analysis, unlock full access below.

UpgradeUpgrade now and get the full article along with these benefits:

- Trade Setups That Work Risk-defined strategies built on insider activity, volatility behavior, momentum shifts, and liquidity dynamics.

- Macro Intelligence and Sector Rotations Early-stage insights into AI infrastructure, defense cycles, energy trends, and emerging tech opportunities.

- Priority Access to Our Best Ideas Deep-dive reports, bonus stock picks, and premium research you will not find in the free feed.